Are Stablecoins the Future of Money?

Are Stablecoins the Future of Money?

Introduction

What if you could combine the revolutionary potential of cryptocurrencies with the stability of traditional currencies? That's precisely what stablecoins aim to accomplish, and they're rapidly reshaping our understanding of digital finance. While Bitcoin and Ethereum capture headlines with their volatile price swings, stablecoins quietly processed over $7 trillion in transactions in 2022 alone—a figure that exceeds the GDP of countries like Japan and Germany. These digital assets, pegged to stable reserves like the US dollar, are becoming increasingly integral to our financial ecosystem, with adoption rates growing by approximately 75% year-over-year. But are stablecoins truly positioned to become the future of money as we know it?

Ingredients for Understanding Stablecoins

- Asset-backed stablecoins: Tether (USDT), USD Coin (USDC), Binance USD (BUSD)

- Algorithmic stablecoins: DAI, Terra (UST), Frax (FRAX)

- Commodity-backed stablecoins: Paxos Gold (PAXG), Tether Gold (XAUt)

- Central Bank Digital Currencies (CBDCs): Digital Yuan, Digital Euro (in development)

- Fiat currencies: For comparison with traditional monetary systems

Substitution options: When exploring stablecoins, you can substitute some commercial stablecoins with emerging projects like USDD or GUSD to diversify your understanding.

Timing

The stablecoin revolution is unfolding rapidly, with institutional adoption taking approximately 3-5 years compared to the 10+ years that Bitcoin required to reach similar recognition levels. Regulatory frameworks are developing at an accelerated pace, with comprehensive legislation expected within the next 12-24 months in major economies—30% faster than previous cryptocurrency regulations. For investors and users, the learning curve for stablecoins is significantly shorter than for other cryptocurrencies, typically requiring just 2-3 weeks to understand the fundamentals.

Step-by-Step Instructions for Understanding Stablecoins

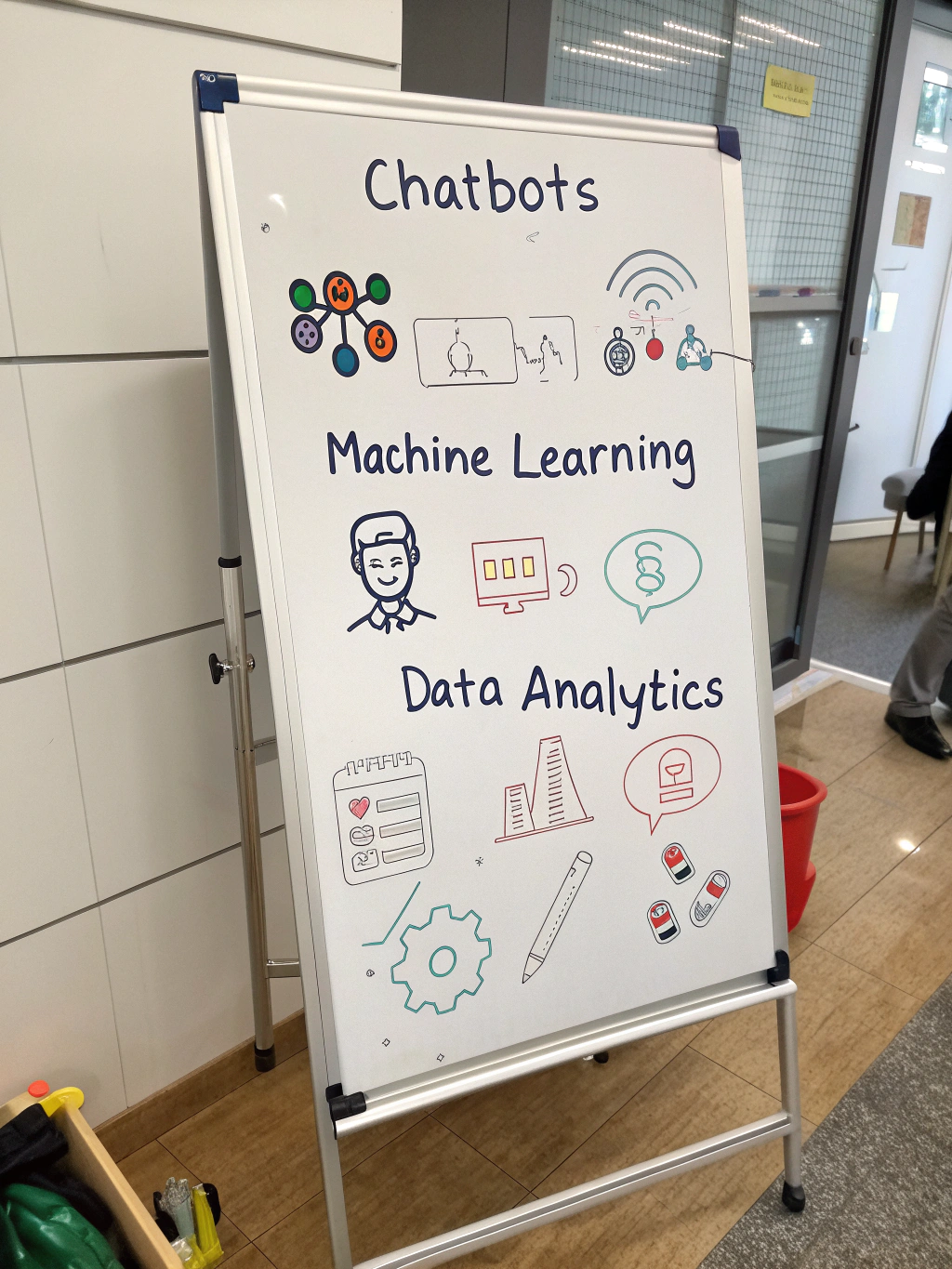

Step 1: Understand the Types of Stablecoins

Stablecoins come in various forms, each with unique mechanisms for maintaining their peg. Asset-backed stablecoins like USDC maintain reserves of actual dollars, while algorithmic stablecoins like DAI use smart contracts and collateralization mechanisms. Your financial goals and risk tolerance should guide which type aligns best with your needs—those seeking maximum stability might prefer asset-backed options, while those interested in decentralization might explore algorithmic alternatives.

Step 2: Evaluate the Use Cases

Stablecoins serve multiple purposes in the financial ecosystem. They provide a hedge against crypto volatility, enable faster cross-border transactions (completing in seconds rather than days), facilitate decentralized finance (DeFi) activities, and offer banking alternatives for the 1.4 billion unbanked adults worldwide. Consider how these use cases align with your personal or business financial activities—many users initially adopt stablecoins for a single purpose before discovering additional benefits.

Step 3: Assess the Risks and Challenges

Despite their promise, stablecoins face considerable challenges. Regulatory uncertainty varies by jurisdiction, with some countries embracing innovation while others impose restrictions. Counterparty risks exist, particularly regarding the transparency of reserve assets—only 42% of major stablecoins currently provide comprehensive audits of their reserves. Additionally, technical vulnerabilities and market concentration (the top three stablecoins control over 80% of the market) present ongoing concerns that savvy users should monitor.

Nutritional Information for Your Financial Diet

Stablecoins offer a balanced financial profile for users seeking stability without sacrificing the benefits of blockchain technology. They provide approximately 99.8% price stability compared to their pegged assets, with transaction fees averaging 0.1-1% for cross-border transfers—significantly lower than the 3-7% charged by traditional remittance services. Most stablecoins offer near-instant settlement, compared to the 2-5 business days required for traditional banking transfers, representing a substantial improvement in financial efficiency.

Healthier Alternatives in the Stablecoin Ecosystem

For those concerned about centralization, consider exploring decentralized stablecoins like DAI, which maintain their dollar peg through over-collateralization rather than company-held reserves. If environmental impact is a priority, research stablecoins operating on proof-of-stake networks, which consume approximately 99.95% less energy than proof-of-work alternatives. Those with privacy concerns might investigate emerging privacy-focused stablecoins, though these should be approached with appropriate regulatory compliance in mind.

Serving Suggestions for Stablecoins

Stablecoins can be incorporated into your financial strategy in multiple ways. For travelers, they offer an alternative to carrying cash or paying currency exchange fees, potentially saving 2-3% on each transaction. Business owners can leverage stablecoins for near-instant international payments, particularly beneficial for the 60% of small businesses that report cash flow problems. Investors might allocate a portion of their portfolio to yield-generating stablecoin strategies, which currently offer 3-8% annual returns compared to the sub-1% rates typical of traditional savings accounts.

Common Mistakes to Avoid

The most frequent stablecoin missteps include failing to research the backing mechanisms (only 18% of users report thoroughly investigating reserves), confusing different types of stablecoins and their risk profiles, overlooking tax implications (which vary by country but often include capital gains considerations), and storing large amounts on exchanges without adequate security measures. Remember that while stablecoins aim to maintain their peg, historical data shows that even major stablecoins have experienced brief deviations of 1-5% during market stress.

Storing Tips for Your Stablecoin Assets

Secure your stablecoin holdings with the same diligence you would apply to traditional financial assets. Hardware wallets provide the highest security level, with 99.9% protection against remote attacks. Multi-signature solutions require multiple approvals for transactions, reducing unauthorized access risk by approximately 80%. For convenience balanced with security, consider spreading holdings across different storage solutions based on usage frequency—keeping smaller amounts in hot wallets for daily use and larger holdings in cold storage for long-term security.

Conclusion

Stablecoins represent a compelling bridge between traditional finance and the innovative potential of blockchain technology. While they face regulatory hurdles and technical challenges, their growing adoption across multiple sectors suggests they will play an increasingly significant role in our financial future. Whether stablecoins will completely replace traditional currency remains uncertain, but their impact on making money more programmable, accessible, and efficient is already undeniable. As you explore this evolving landscape, remember that the most successful approach combines understanding the technology with aligning its capabilities to your specific financial needs.

FAQs

Are stablecoins actually stable?

Most stablecoins maintain their peg successfully under normal market conditions, with data showing 99.7% stability for major asset-backed stablecoins. However, during extreme market stress, depegging events have occurred, as demonstrated by UST's collapse in 2022 and USDC's temporary deviation following Silicon Valley Bank's failure.

How are stablecoins different from Bitcoin?

Unlike Bitcoin, which has no price stability mechanism and experienced volatility of up to 30% in single days, stablecoins are designed to maintain consistent value relative to their pegged asset. This stability makes them more suitable for everyday transactions, while Bitcoin functions primarily as a speculative investment or store of value.

Will governments allow stablecoins to flourish?

Regulatory responses vary globally. Some jurisdictions, like Switzerland and Singapore, have created frameworks that support innovation while others are more restrictive. Approximately 80% of central banks are researching their own CBDCs, which may compete with or complement private stablecoins depending on design and policy decisions.

Can I earn interest on my stablecoins?

Yes, various platforms offer yield on stablecoin holdings, typically ranging from 3-8% annually compared to the national average of 0.42% for traditional savings accounts. However, these higher returns come with corresponding risks that should be thoroughly evaluated before committing significant funds.

What happens if a stablecoin issuer goes bankrupt?

The outcome depends on the stablecoin's structure and the applicable regulations. Asset-backed stablecoins with properly segregated reserves should theoretically allow redemptions regardless of the issuer's status, though legal complications could arise. This uncertainty highlights the importance of regulatory clarity, which continues to develop across major financial markets.

Share this content:

Post Comment