AI Funding Frenzy: Where Venture Capital Is Placing Billion-Dollar Bets in 2024

.

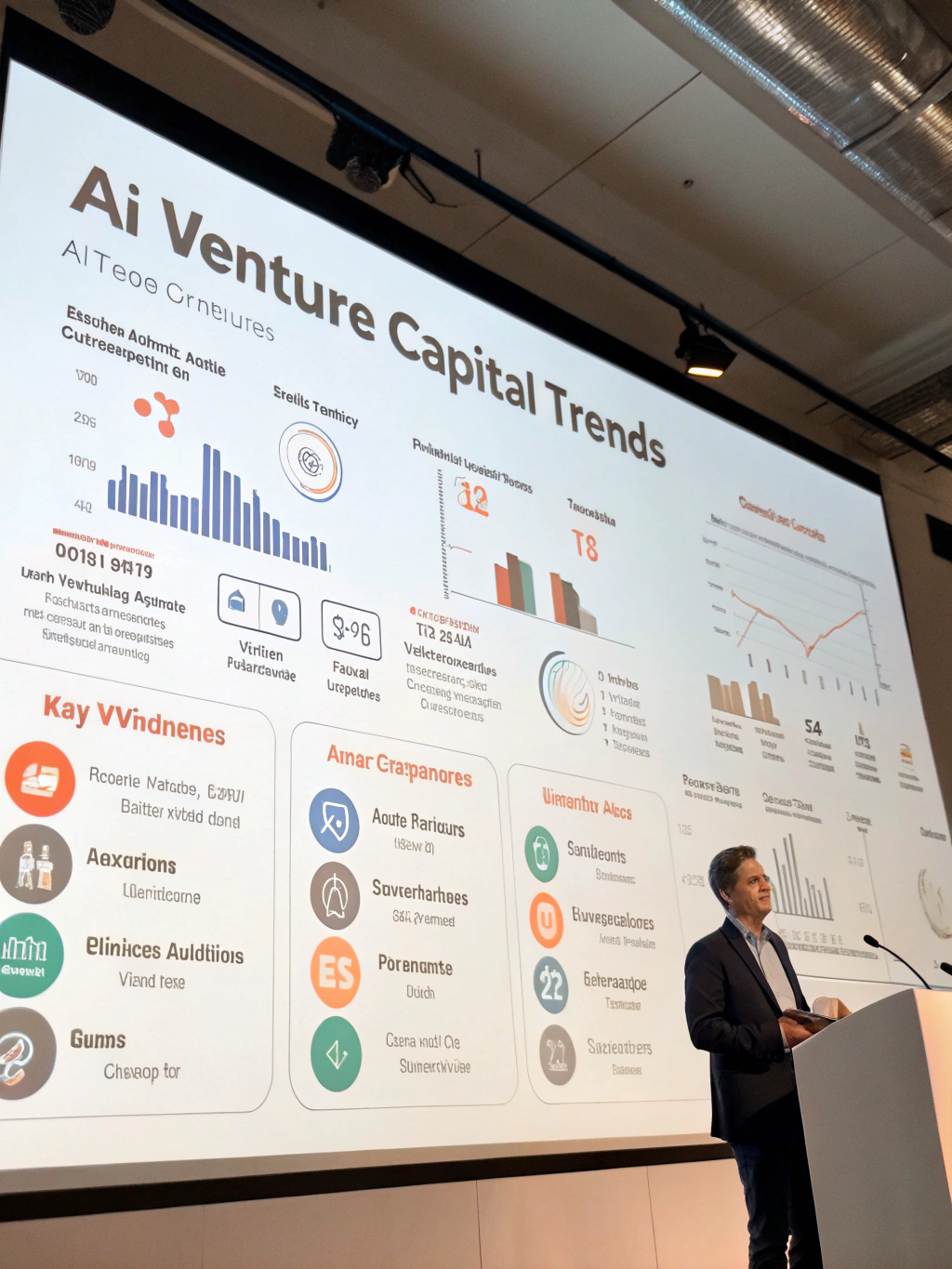

Navigating the AI Revolution: Unpacking AI Venture Capital Trends

Have you ever wondered how the relentless advancements in artificial intelligence are reshaping the financial landscape? With trillions of dollars flowing into innovative tech, understanding the current AI Venture Capital Trends is no longer optional – it's crucial for investors, entrepreneurs, and anyone seeking to stay ahead of the curve. The convergence of powerful algorithms, vast datasets, and increasing computing capabilities is fueling a new era of investment, demanding a nuanced perspective. This post delves deep into the heart of this transformation, exploring the key concepts, market dynamics, and future outlook of AI Venture Capital Trends.

Key Concepts & Trends

The AI landscape is evolving at an astonishing pace. Several key concepts and trends are driving investment decisions in the current climate. One significant shift is the rise of generative AI, exemplified by models like GPT-4 and DALL-E 2. These technologies aren’t just buzzwords; they’re foundational building blocks for countless applications, from content creation and software development to drug discovery and financial modeling. Consider the analogy of the early internet – initially, the infrastructure was rudimentary, but it paved the way for the e-commerce giants we know today. Similarly, generative AI is laying the groundwork for a new wave of disruptive businesses.

Another prominent trend is the increasing focus on AI infrastructure. This includes investments in specialized hardware like GPUs, cloud computing platforms optimized for AI workloads, and data management solutions. Companies providing these foundational elements are attracting substantial VC funding. We're also witnessing a surge in AI-powered cybersecurity tools, a direct response to the growing sophistication of cyber threats. Finally, the democratization of AI through platforms offering no-code/low-code AI development tools is expanding the pool of potential AI startups. These tools empower businesses without specialized AI expertise to integrate AI into their operations.

Data & Market Insights

The numbers speak volumes. According to a recent report by example.com/global-ai-investment-report (also known as startup funding AI), global AI investment reached $112 billion in 2023. This represents a significant 20% increase year-over-year, demonstrating the unwavering confidence in the sector. A significant portion of this investment is flowing into areas like machine learning, deep learning, natural language processing, and computer vision.

A visual representation of this trend is evident in the increasing number of AI-related patents filed globally. The World Intellectual Property Organization (WIPO) reported a 35% rise in AI patents in 2023 compared to the previous year. Furthermore, a study by McKinsey indicates that AI has the potential to add $13 trillion to the global economy by 2030, highlighting the immense market opportunity.

Smarter Strategies & Alternatives

Optimizing your investment strategy in the AI space requires a discerning approach. Instead of chasing every hot trend, focusing on companies with strong fundamentals, a clear value proposition, and a sustainable business model is crucial. Diversification remains vital. Consider allocating capital across different AI sub-sectors (e.g., healthcare AI, fintech AI, enterprise AI) to mitigate risk.

Beyond traditional VC, alternative investment platforms are emerging. AI-focused crowdfunding platforms are enabling smaller investors to participate in early-stage AI ventures. Specialized AI investment funds are also gaining traction, offering access to curated portfolios managed by experienced professionals. For those looking for a more risk-aware approach, consider investing in publicly traded companies that are strategically integrating AI into their operations, rather than betting solely on unproven startups.

Use Cases & Applications

The applications of AI are expanding across industries. In healthcare, AI is revolutionizing diagnostics, drug discovery, and personalized medicine. Companies like PathAI are using AI to improve the accuracy of cancer diagnoses. In finance, AI is being leveraged for fraud detection, algorithmic trading, and personalized financial advice. Many fintech startups are using AI to offer more accessible and efficient financial services.

Consider the example of self-driving cars—a long-term application of AI that is attracting billions in investment. Companies like Waymo and Tesla are at the forefront of this revolution, showcasing the transformative potential of autonomous systems. Beyond these headline-grabbing applications, AI is quietly but effectively improving customer service through chatbots, optimizing supply chains, and enhancing marketing campaigns.

Common Mistakes to Avoid

Navigating the AI investment landscape isn’t without its pitfalls. One common mistake is overvaluing hype and neglecting thorough due diligence. It's easy to get caught up in the excitement surrounding new technologies, but it's essential to critically evaluate a company's technology, team, and market potential. Another frequent error is focusing solely on technical capabilities without considering the practical application and scalability of the AI solution.

Furthermore, neglecting the ethical implications of AI is a crucial oversight. Investors need to assess how a company is addressing issues like data privacy, algorithmic bias, and responsible AI development. A recent report by the Brookings Institution highlighted the growing concerns around algorithmic bias in AI systems, emphasizing the need for ethical frameworks and accountability.

Maintenance, Security & Long-Term Planning

For businesses integrating AI, ongoing maintenance and security are paramount. AI models require continuous training and updating to maintain accuracy and relevance. Implementing robust cybersecurity measures is critical to protect sensitive data and prevent malicious attacks. Compliance with data privacy regulations like GDPR and CCPA is also essential.

Long-term planning involves anticipating future technological advancements and adapting your AI strategy accordingly. This includes investing in talent development, fostering a data-driven culture, and staying informed about regulatory changes. Scalability is another key consideration – can your AI solution handle increasing data volumes and user demand?

Summary & Key Takeaways

The AI Venture Capital Trends are undeniably creating a powerful wave of innovation. Investment is surging, groundbreaking applications are emerging, and the potential for economic disruption is immense. However, success in this rapidly evolving field requires a strategic, informed, and ethical approach. Remember to prioritize fundamental strength, diversify your investments, avoid hype-driven decisions, and address the long-term implications of AI adoption. The future is undoubtedly powered by AI, and understanding these trends is key to unlocking its potential.

What are your thoughts on the future of AI venture capital? Share your insights and experiences in the comments below!

FAQs

Is it too late to invest in crypto?

Investment in cryptocurrencies remains highly volatile. While the hype surrounding crypto has cooled, the underlying technology (blockchain) continues to evolve, and AI is increasingly being integrated into crypto platforms for trading and security. However, it’s crucial to conduct thorough research and understand the risks involved before investing in any cryptocurrency.

How can small businesses use AI?

Small businesses can leverage AI through readily available tools like AI-powered marketing platforms, customer relationship management (CRM) systems, and chatbots. These tools can automate tasks, improve customer engagement, and gain valuable insights from data.

What tech stacks scale best?

Tech stacks that are cloud-native, modular, and utilize microservices architecture generally scale best for AI applications. These architectures offer flexibility and allow for independent scaling of different components of the system.

Share this content:

Post Comment