Make.com Advanced Automation Tutorial

The Future is Automated: A Guide to Effortless Integration for Crypto, Stocks, and Beyond

Are you feeling overwhelmed by the constant flux of information – from volatile crypto markets and fluctuating stock prices to emerging AI agents and alternative investment strategies? You’re not alone. In today’s rapidly evolving landscape, time is your most valuable asset. That’s where powerful automation comes in. This comprehensive guide explores how to leverage tools like Make (formerly Integromat) for seamless integration, unlocking efficiencies in your investment strategies, crypto portfolio management, and even AI-powered workflows. We’ll delve into real-world applications, offering a practical make-com automation guide to help you streamline your processes and stay ahead of the curve.

Why Automation is No Longer Optional

The sheer volume of data in finance and technology is staggering. Manually tracking price movements, executing trades, gathering research, or even simply organizing information is a time-consuming burden. This inevitably leads to missed opportunities and increased risk. Automation bridges this gap, allowing you to:

- React Faster: Automated systems can respond to market changes in milliseconds, allowing for swift execution of buy/sell orders.

- Reduce Errors: Eliminating manual steps drastically reduces the possibility of human error in data entry and transaction processing.

- Gain a Competitive Edge: By automating repetitive tasks, you free up valuable time for strategic decision-making and exploring new investment avenues, like navigating the decentralized finance (DeFi) space or optimizing your algorithmic trading strategies.

- Scale Efficiently: Handle growing volumes of data and transactions without increasing headcount.

Unlocking the Power of Make: Your Automation Platform

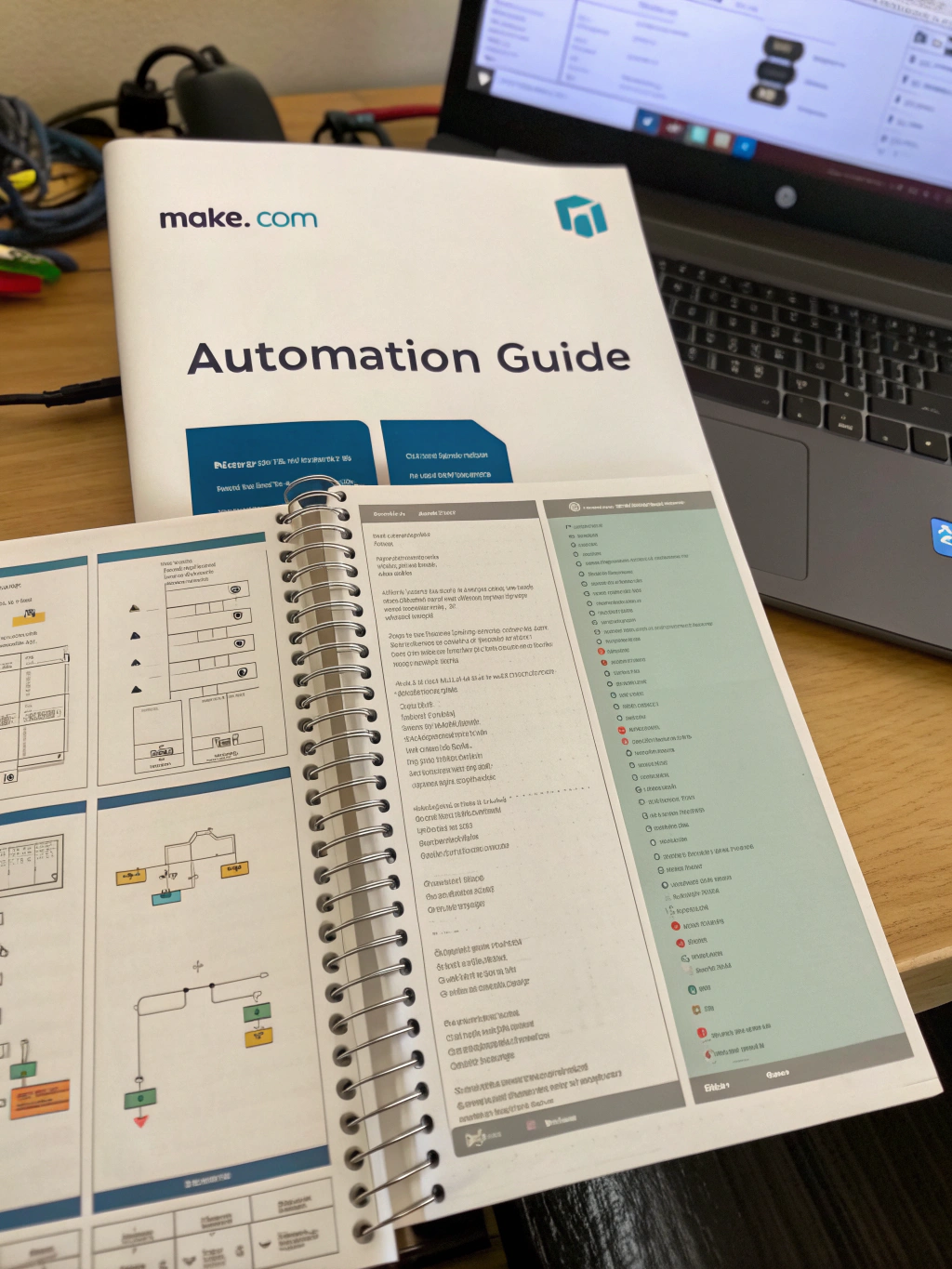

Make (formerly Integromat) is a leading no-code automation platform that connects your favorite apps and services. It allows you to build automated workflows – also known as “scenarios” – without writing a single line of code. This makes it accessible to everyone, regardless of technical expertise. Understanding how to build effective make scenario tutorials is key to unlocking Make’s full potential.

Building Your First Scenario: A Simple Example

Let’s start with a basic example: automatically saving new leads from a Facebook ad campaign into a Google Sheets spreadsheet. This demonstrates the core functionality of Make and provides a solid foundation for more complex automations.

- Trigger: Select “Facebook Lead Ads” as your trigger. This will monitor new lead submissions in your Facebook account.

- Action: Choose “Google Sheets” as your action. Select the spreadsheet and the specific sheet where you want the data to be saved.

- Mapping: Map the fields from the Facebook lead ad (e.g., name, email, phone number) to the corresponding columns in your Google Sheet.

- Test & Activate: Test your scenario and then turn it on. Now, every new lead submitted through your Facebook ad will automatically be added to your Google Sheet. Further complex scenarios involving API calls, webhooks, and conditional logic are easily achievable with some practice.

Automation for Specific Use Cases: Crypto, Stocks, and Beyond

Crypto Portfolio Management Automation

Managing a crypto portfolio involves constant monitoring of prices, tracking market trends, and potentially executing trades. Make can automate many aspects of this process:

- Price Alerts: Create scenarios that trigger notifications when Bitcoin or Ethereum reaches a specific price point. This is particularly useful for swing trading and setting stop-loss orders.

- Portfolio Tracking: Connect your crypto exchange (Binance, Coinbase, Kraken) to Make and automatically track your portfolio balance and asset allocation.

- Tax Reporting: Automate the collection of transaction data from your exchange to simplify tax reporting. Integrations with accounting software via Make can be invaluable.

- DeFi Yield Optimization: Monitor various DeFi platforms (Aave, Compound) and automatically rebalance your strategies to maximize yield based on changing interest rates. Automated strategies can even trigger swaps on decentralized exchanges (DEX) for optimal lending or borrowing opportunities.

Stock Market Automation

Automating tasks related to stock investing can significantly enhance efficiency:

- News Alerts: Set up scenarios that monitor financial news sources (Bloomberg, Reuters) for mentions of specific stocks or companies, triggering alerts based on predetermined keywords or sentiment analysis.

- Dividend Tracking: Automatically track dividend payments from your holdings and update your investment records.

- Algorithmic Trading: Though requiring more technical expertise, Make can be integrated with trading APIs to automate the execution of algorithmic trading strategies, based on pre-defined rules (e.g., moving averages, RSI).

- Financial Data Aggregation: Gather market data from multiple sources (Yahoo Finance, Alpha Vantage) and consolidate it into a single dashboard for analysis. This simplifies your research process enormously and allows for faster investment decisions.

AI Agents & Automation: The Next Frontier

The rise of AI agents is transforming the investment landscape. Make can be used to connect AI tools with your investment workflows creating powerful automated systems.

- Sentiment Analysis Integration: Integrate AI-powered sentiment analysis tools with your trading platform to automatically assess market sentiment and adjust your investment strategy accordingly.

- Automated Research & Reporting: Use AI agents to automatically gather and summarize financial reports, news articles, and social media sentiment, generating concise and actionable insights.

- Personalized Investment Recommendations: Connect Make with AI recommendation engines to receive personalized investment suggestions based on your risk tolerance and financial goals.

Making the Most of Make: Resources and Community

Ready to dive deeper? The Make community is a fantastic resource for finding inspiration and learning from others. Check out these helpful resources:

- Make’s Official Documentation

- The Make Community Forum: https://community.make.com/

- Numerous make scenario tutorials available on YouTube and other platforms.

| Use Case | Trigger | Action | Benefit |

|---|---|---|---|

| Crypto Price Alert | Crypto Exchange (e.g., Binance) | Email/SMS Notification | Reacts instantly to price movements |

| Stock News Alert | Financial News Source (e.g., Reuters) | Email/Slack Notification | Stay informed about critical financial events |

| Portfolio Tracking | Crypto Exchange | Google Sheets/Excel | Centralized view of portfolio performance |

| DeFi Yield Optimization | DeFi Platform (Aave, Compound) | DEX Swap | Maximizes yield through automated rebalancing |

Embrace the Future of Investing

Automation isn’t just a technological trend; it’s a fundamental shift in how we approach finance and investing. By embracing tools like Make, you can gain a significant advantage, streamline your workflows, and free up valuable time to focus on what matters most: strategic decision-making and achieving your financial goals. The make-com automation guide provided here is just a starting point. Explore the possibilities and unlock the full potential of automation for your investment journey.

What are your biggest automation challenges? Share your thoughts and questions in the comments below! Don’t forget to share this article with your network. Consider exploring further with a detailed make scenario tutorial on advanced data transformation.

Share this content:

Post Comment