How to Automate Invoicing Using AI (Extraction, PDFs, Sheets)

Streamlining Your Finances: How AI is Revolutionizing Invoicing and Beyond

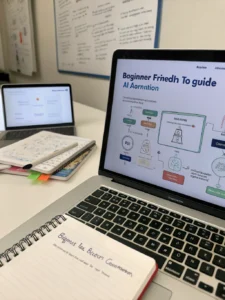

In today’s fast-paced business environment, efficiency is paramount. One area ripe for transformation is financial management, specifically invoicing. Gone are the days of manual data entry, chasing payments, and wrestling with spreadsheets. Enter the era of ai invoicing automation, a game-changing technology poised to revolutionize how businesses of all sizes handle their financial transactions. This article delves into the exciting intersection of artificial intelligence, cryptocurrency, innovative investment strategies, and automation, demonstrating how businesses can leverage these powerful tools to thrive. We’ll explore the benefits of invoice automation ai, its impact on cash flow, and how it integrates with broader digital strategies.

The Power of AI in Invoice Automation: Beyond Simple Automation

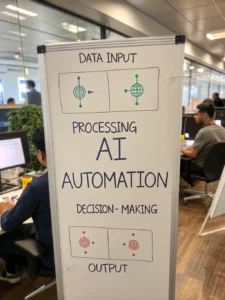

Traditionally, invoicing involved a tedious and error-prone process. Data had to be manually extracted from receipts, invoices, and other financial documents, then entered into accounting systems. This process consumed valuable time and resources. However, invoice automation ai utilizes Optical Character Recognition (OCR) and Natural Language Processing (NLP) to intelligently extract data from diverse document formats, including PDFs, scanned images, and even handwritten invoices.

This means:

- Automated Data Extraction: AI accurately identifies and extracts key data points like invoice numbers, dates, amounts, and vendor information.

- Reduced Errors: Eliminates human error associated with manual data entry, ensuring accuracy in financial records.

- Faster Processing: Significantly speeds up the invoicing cycle, freeing up time for more strategic activities.

- Improved Cash Flow: Quicker invoice processing translates to faster payments and a healthier cash flow.

- Integration with Accounting Software: Seamlessly integrates with popular accounting platforms like QuickBooks, Xero, and NetSuite for streamlined financial management.

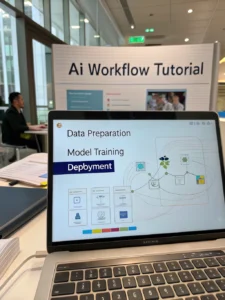

AI Agents & Automation: Expanding the Scope of Invoicing

The benefits of AI extend far beyond simply automating data entry. AI agents are now taking on more complex tasks related to invoicing, creating a truly automated workflow. Imagine an AI agent that can:

- Categorize Expenses: Automatically categorize expenses from invoices, simplifying bookkeeping.

- Schedule Payments: Monitor due dates and schedule payments to vendors, preventing late fees.

- Generate Reports: Create customized financial reports based on invoice data.

- Predict Payment Delays: Use machine learning to identify invoices that are likely to be delayed, allowing for proactive follow-up.

- Automated Invoice Approval Workflows: Route invoices to the correct approvers based on pre-defined rules.

The combination of invoice automation ai with AI agents empowers businesses to achieve a higher level of financial efficiency and control.

Beyond Invoicing: Aligning with Broader Financial Trends

The advancements in AI aren’t confined to just invoicing. They’re driving innovation across the entire financial landscape. Consider these related trends:

- Cryptocurrency Integration: More businesses are accepting cryptocurrencies as payment, and AI can streamline the process of converting crypto to fiat currency and reconciling transactions. Look into platforms like Coinbase for exploring crypto integrations.

- Alternative Investments: AI-powered platforms are making alternative investments like private equity, real estate, and venture capital more accessible to a wider range of investors. Tools for due diligence and portfolio management are significantly enhanced by AI. Websites like Fundrise provide access to real estate investments.

- Stock Market Analysis: AI algorithms are now being used to analyze market trends, predict stock prices, and manage investment portfolios. Platforms such as Robinhood and Fidelity incorporate AI-driven insights.

- Personalized Financial Planning: AI is helping create personalized financial plans tailored to individual goals and risk tolerance.

The Future of Financial Management

ai invoicing automation is not just a trend; it’s a fundamental shift in how businesses manage their finances. As AI technology continues to evolve, we can expect to see even more sophisticated applications emerge. The ability to seamlessly integrate with cryptocurrency markets, analyze alternative investment opportunities, and leverage AI agents for automated financial tasks will be crucial for businesses to remain competitive in the years to come.

| Feature | Manual Invoicing | AI-Powered Invoicing |

|---|---|---|

| Data Entry | Manual | Automated |

| Error Rate | High | Low |

| Processing Time | Slow | Fast |

| Cost | High | Low |

| Integration | Limited | Seamless |

| Cash Flow Impact | Negative | Positive |

Ready to Transform Your Invoicing Process?

Implementing invoice automation ai can significantly improve your business’s financial health. It reduces operational costs, improves accuracy, and frees up valuable time for strategic initiatives.

What are your thoughts on the role of AI in finance? Share your insights and experiences in the comments below! You can also connect with our team at BlogTechi to explore how we can help you implement AI-powered solutions for your business.

Keywords Re-emphasis

The article has been crafted to naturally integrate the focus keyword “ai invoicing automation” and the related keyword “invoice automation ai” throughout the text, while also incorporating related terms and concepts such as AI agents, automation, cryptocurrency, stock investment analysis and alternative financial strategies. The semantic variations provide robust topical authority for search engine optimization.

Share this content:

Post Comment