How to Automate Database Updates Using AI (SQL + APIs)

The AI Revolution is Reshaping Finance: How ai database automation is Leading the Charge

The financial landscape is undergoing a seismic shift. Driven by rapid advancements in artificial intelligence and readily available data, institutions are seeking ways to gain a competitive edge. One of the most crucial, yet often overlooked, areas for transformation is data management. Enter ai database automation – a game-changing technology that promises to streamline operations, improve accuracy, and unlock unprecedented insights in areas ranging from cryptocurrency markets to traditional stock investments. This blog post delves into the exciting world of AI-powered data management and explores its impact on various aspects of finance.

Why is ai database automation Critical in Today’s Financial World?

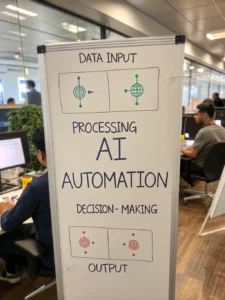

The sheer volume of data generated daily in finance is staggering. From stock market feeds and crypto transactions to customer data and economic indicators, managing this deluge is a monumental task. Traditional methods of data entry, validation, and analysis are often slow, error-prone, and costly. This is where automate databases comes in. AI-powered solutions can handle these tasks with remarkable speed and accuracy, freeing up human analysts to focus on higher-level strategic thinking.

Here’s a closer look at the key benefits:

- Enhanced Efficiency: Automate repetitive data tasks, reducing manual effort and accelerating workflows.

- Improved Accuracy: Minimize human errors through intelligent validation and data cleansing.

- Real-time Insights: Process data instantaneously, providing up-to-the-minute intelligence for informed decision-making.

- Cost Reduction: Lower operational costs by optimizing data management processes.

- Scalability: Easily adapt to growing data volumes without sacrificing performance.

- Better Risk Management: Improve fraud detection and regulatory compliance with AI-powered monitoring.

AI Agents & Automation Transforming Investment Strategies

The rise of AI agents and sophisticated automation platforms is revolutionizing investment strategies across the board. These agents can analyze vast datasets, identify patterns, and execute trades with minimal human intervention. This is particularly impactful in areas like:

- Algorithmic Trading: AI agents can develop and execute complex trading algorithms based on real-time market data. Companies like Two Sigma are at the forefront of this movement.

- Portfolio Optimization: AI can help optimize investment portfolios by considering risk tolerance, financial goals, and market conditions.

- Sentiment Analysis: AI algorithms can analyze news articles, social media posts, and other sources to assess market sentiment and predict price movements. Tools like RavenPack specialize in this area.

- Cryptocurrency Market Analysis: The volatile crypto markets benefit significantly from AI-powered analysis. AI agents can monitor blockchain activity, identify emerging trends, and assess the risk of different cryptocurrencies.

Navigating the Crypto Markets with AI automate databases

The cryptocurrency space is uniquely positioned to benefit from ai database automation to manage the sheer complexity of data. Analyzing blockchain transactions, price charts, social media sentiment, and news feeds requires immense computational power and sophisticated analytical techniques. AI tools can:

- Monitor Blockchain Activity: Track transactions, identify suspicious patterns, and detect potential scams. Platforms like Glassnode are industry leaders.

- Predict Price Movements: Develop predictive models based on historical data and real-time market indicators.

- Manage Portfolio Risk: Dynamically adjust portfolio allocations based on market conditions and risk assessments.

- Automated Reporting: Create comprehensive reports on crypto holdings and performance.

While the crypto market carries inherent risks, these AI-driven tools are empowering investors to make more informed decisions and navigate the complexities of this rapidly evolving landscape.

Stock Investments and AI-Driven Data Analysis

The traditional stock market is also adopting AI-driven data analysis. Investment firms are leveraging AI to:

- Fundamental Analysis: AI algorithms can analyze financial statements, economic data, and industry trends to identify undervalued stocks.

- Technical Analysis: AI can identify patterns in stock price charts to predict future price movements.

- Predictive Analytics: AI models can forecast earnings, revenue, and other key financial metrics.

- Customer Profiling: Analyze customer data to identify investment opportunities and tailor financial products to individual needs.

The integration of AI into stock investment strategies is not about replacing human analysts; it’s about augmenting their capabilities and providing them with the insights they need to succeed.

Alternative Investments and the Power of AI

Beyond traditional stocks and crypto, alternative investments – private equity, real estate, hedge funds, and commodities – are also benefiting from AI-powered data management. automate databases can improve decision-making in these areas by:

- Due Diligence: AI can automate the process of gathering and analyzing information about potential investments.

- Risk Assessment: AI algorithms can assess the risks associated with different alternative investments.

- Performance Monitoring: AI can track the performance of alternative investments and identify areas for improvement.

Here’s a quick comparison of financial instruments:

| Instrument | Risk Level | Potential Return | Data Complexity | AI Use Cases |

|---|---|---|---|---|

| Stocks | Moderate | Moderate | Moderate | Algorithmic trading, sentiment analysis |

| Cryptocurrency | High | Very High | Very High | Blockchain analysis, price prediction |

| Bonds | Low | Low | Low | Credit risk assessment, portfolio optimization |

| Real Estate | Moderate to High | Moderate to High | Moderate | Property valuation, market analysis |

| Private Equity | High | Very High | High | Due diligence, performance monitoring |

Embracing the Future of Finance

Ai database automation is no longer a futuristic concept; it’s a present-day reality that is reshaping the financial industry. As AI technology continues to evolve, we can expect to see even more innovative applications emerge. Financial institutions that embrace these advancements will be best positioned to thrive in the years to come.

Ready to learn more about how AI can transform your data management?

ai database automation can be a significant boost to your business. Share your thoughts in the comments below!

Don’t forget to subscribe to our newsletter for more insights on the intersection of AI, finance, and technology.

Share this content:

Post Comment