Demystifying Private Equity: Effective Investment Strategies for High-Net-Worth Individuals

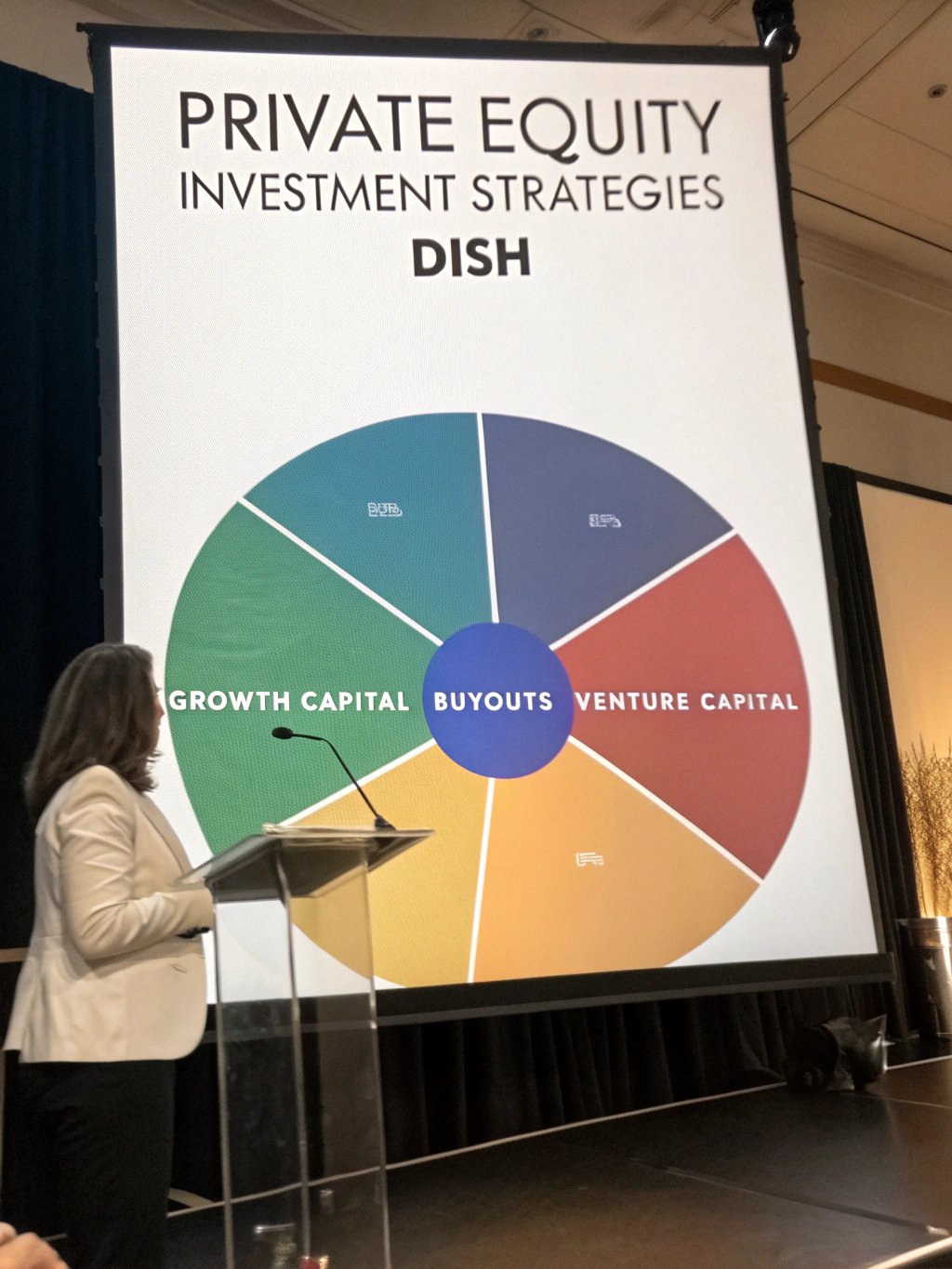

Navigating the Future of Wealth: Exploring Private Equity Investment Strategies The financial landscape is rapidly evolving. Traditional investments are facing new challenges, and investors are increasingly seeking opportunities beyond the stock market. This shift has propelled alternative investments, particularly private equity investment strategies, into the spotlight. But what exactly are these strategies, and are they right for you? This comprehensive guide dives deep into the world of private equity, exploring its potential, risks, and how it fits into a well-rounded investment portfolio. We'll examine the trends shaping the future of wealth management and how seasoned investors are leveraging these strategies to achieve superior returns. What is Private Equity and Why is it Gaining Traction? At its core, private equity (PE) involves investing in companies that aren't publicly traded on stock exchanges. This can take various forms, including buying out existing businesses, investing in startups, or providing capital for growth initiatives. Alternative investments like private equity offer the potential for higher returns compared to traditional assets like bonds or stocks—though this often comes with increased risk and illiquidity. The surge in popularity can be attributed to a confluence of factors: Low Interest Rate Environment: Historically low interest rates have made fixed-income investments less attractive, pushing investors towards higher-yielding alternatives. Corporate Restructuring & Turnaround Opportunities: Private equity firms often specialize in identifying undervalued companies with potential for improvement through operational changes and strategic realignment. Technological Disruption: As industries transform, private equity provides capital to innovative companies poised to capitalize on new technologies. Increased Institutional Interest: Pension funds, endowments, and sovereign wealth funds are allocating larger portions of their portfolios to alternative investments. Unpacking Key Private Equity Investment Strategies There's no one-size-fits-all approach to private equity. Several distinct strategies cater to varying risk tolerances and investment goals: Buyouts The most well-known PE strategy involves acquiring a controlling stake in a mature company. Buyout firms use a combination of equity and debt to finance these acquisitions. They then work with the company's management team to improve operations, reduce costs, and enhance profitability. A classic example is leveraged buyouts, where a significant portion of the acquisition cost is financed with borrowed money. Successful buyouts often involve: Operational Efficiency Improvements Strategic Repositioning Financial Restructuring Management Team Enhancement Venture Capital (VC) VC focuses on investing in early-stage, high-growth companies—typically startups—with disruptive potential. VC firms provide capital in exchange for equity, often taking an active role in guiding the company's development. VC investments are inherently riskier than buyouts but offer the potential for much higher returns if the company succeeds. Seed Funding: Early-stage investment to get a startup off the ground. Series A, B, C Funding: Subsequent rounds of investment to support growth and expansion. Focus on Innovation: Targeting companies in emerging technologies and industries. Growth Equity Growth equity investments occur in established companies that are already profitable but lack the capital for rapid expansion. Growth equity firms provide capital to fuel growth initiatives such as acquisitions, expansion into new markets, or product development. Distressed Investing This strategy involves investing in companies facing financial difficulties, such as those undergoing restructuring or bankruptcy. Distressed investors aim to profit from the turnaround of the company or the sale of its assets. Assessing the Risks & Rewards of Private Equity While private equity investment strategies hold immense potential, it's crucial to understand the associated risks. Risks: Illiquidity: Private equity investments are generally illiquid, meaning you can't easily sell your stake. Investment horizons are typically 5-10 years or longer. alternative investments like these are not suitable for short-term liquidity needs. Higher Fees: Private equity firms typically charge higher fees than traditional investment managers, including management fees and carried interest (a share of the profits). Limited Transparency: Less transparency compared to publicly traded companies can make it harder to assess performance and risk. Valuation Challenges: Determining the fair value of private companies can be complex. Rewards: Potential for Higher Returns: Historically, private equity has generated higher returns than public markets. Diversification: PE investments can provide diversification benefits to a portfolio. Active Management: PE firms provide active management and strategic guidance. Access to Exclusive Opportunities: PE can offer access to investment opportunities that are not available to retail investors. Strategy Investment Stage Risk Level Potential Return Liquidity Buyout Mature Moderate High Low Venture Capital Early-Stage High Very High Very Low Growth Equity Established Moderate High Low Distressed Investing Financial Distress High High Low Building a Private Equity Strategy into Your Portfolio How does one incorporate private equity investment strategies into their investment plan? Assess Your Risk Tolerance: Understand your ability to withstand potential losses and your investment time horizon. Determine Your Investment Goals: What are you hoping to achieve with PE investments? Consider Your Investment Horizon: PE investments are long-term commitments. Work with a Qualified Advisor: Seek guidance from a financial advisor who specializes in alternative investments. Diversify Your PE Investments: Don’t put all your eggs in one basket. Spreading investments across different strategies and sectors can mitigate risk. The Future of Private Equity: AI & Automation The future of private equity investment strategies is inextricably linked to advancements in artificial intelligence (AI) and automation. AI is being used to: Enhance Deal Sourcing: AI algorithms can analyze vast datasets to identify promising investment opportunities. Improve Due Diligence: AI can automate the process of reviewing financial statements, legal documents, and other relevant information. Optimize Portfolio Management: AI can help PE firms manage their portfolios more efficiently and identify potential risks. Accelerate Operations and Restructuring: Automated systems are making operational improvements and restructuring processes faster and more effective. Conclusion: Embracing the Next Wave of Wealth Creation Private equity investment strategies offer compelling opportunities for investors seeking higher returns and portfolio diversification. While risks are inherent, a well-informed approach, coupled with professional guidance, can unlock significant potential. As technology continues to reshape the investment landscape, AI and automation will play an increasingly important role in driving success. Ready to delve deeper? Share your thoughts on private equity in the comments below. What are your biggest questions or concerns? You can also explore other alternative investments on our blog or contact us for a consultation to discuss how PE might fit into your financial plan.

Share this content:

Post Comment