How Generative AI is Revolutionizing Business Investment Decisions

.

Is Your Investment Strategy Stuck in the Past? How AI-driven investment strategies are Reshaping the Financial Landscape

The financial world is undergoing a seismic shift, driven by one powerful force: artificial intelligence. But are traditional investment approaches still relevant in this rapidly evolving landscape? With the rise of sophisticated algorithms and machine learning, the question isn’t if AI will impact investing, but how. This post will delve deep into the world of AI-driven investment strategies and explore the opportunities and challenges they present for both seasoned investors and newcomers alike. We'll unpack the latest trends, analyze market data, and offer practical insights to help you navigate this transformation and potentially enhance your portfolio performance. Furthermore, we'll examine the potent influence of generative AI in finance, a key driver of this revolution.

Key Concepts & Trends

The realm of AI in finance is no longer theoretical; it’s actively being implemented across various investment domains. At its core, AI-driven investment strategies leverage algorithms to analyze vast datasets, identify patterns, and make predictions – far surpassing human capabilities in speed and scale. Several key trends are shaping this space:

- Algorithmic Trading: This is perhaps the most well-known application. AI algorithms execute trades based on pre-defined rules and market conditions, removing emotional bias and capitalizing on fleeting opportunities. High-frequency trading (HFT), a subset of algorithmic trading, has been heavily influenced by AI, though it remains a controversial area.

- Robo-Advisors: These platforms use AI to provide automated, algorithm-driven financial planning services. They assess risk tolerance, set financial goals, and manage investment portfolios with minimal human intervention. This trend has democratized access to investment management, particularly for smaller investors.

- Sentiment Analysis: AI can analyze news articles, social media posts, and financial reports to gauge market sentiment. This allows investors to anticipate potential shifts in asset prices based on public perception. For example, analyzing Twitter data for mentions of a company can reveal early signals of positive or negative news.

- Predictive Analytics: Machine learning models can forecast future market movements by analyzing historical data, economic indicators, and other relevant factors. These predictions, while not foolproof, provide valuable insights for portfolio allocation.

- Natural Language Processing (NLP): NLP is enabling AI to understand and interpret unstructured data like analyst reports and earnings calls, extracting key insights that would be difficult for humans to process manually. This is particularly valuable for fundamental analysis.

Data & Market Insights

The impact of AI in investment isn’t hype; it's backed by significant market activity and impressive growth. According to a recent report by Grand View Research, the global AI in finance market size was valued at USD 17.46 billion in 2023 and is projected to reach USD 120.26 billion by 2030, growing at a CAGR of 27.8% from 2024 to 2030. This explosive growth highlights the increasing adoption of AI by financial institutions.

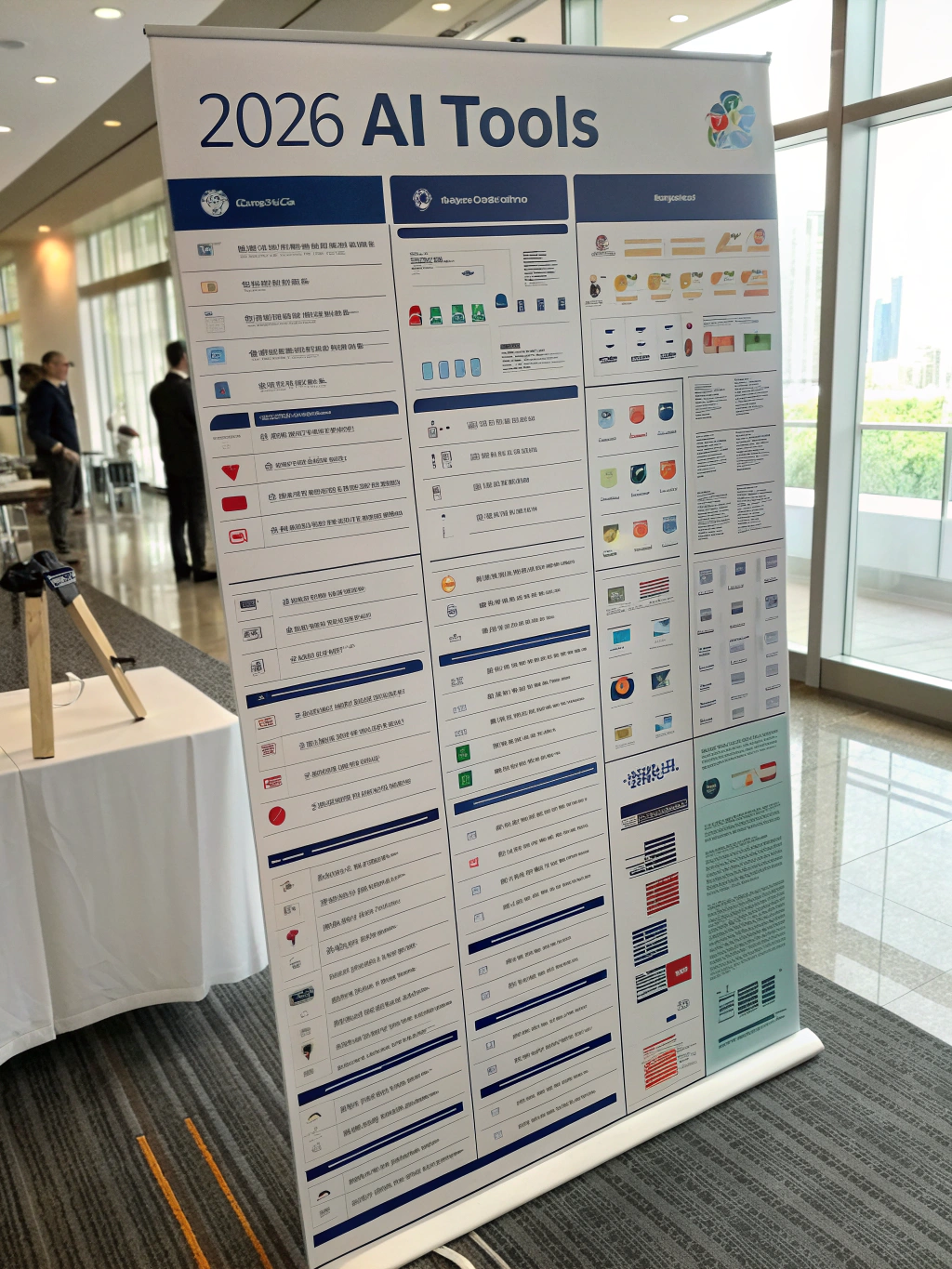

[Include an infographic here visualizing the predicted growth of the AI in finance market]

A McKinsey study found that AI could automate up to 30% of current investment management tasks. The adoption rate is particularly high among larger firms, but even smaller investment firms are beginning to leverage AI-powered tools for tasks like risk assessment and portfolio optimization. Moreover, the integration of generative AI in finance is gaining traction with firms exploring its capabilities in generating investment ideas, creating customized reports, and automating compliance processes.

Smarter Strategies & Alternatives

To truly benefit from AI-driven investment strategies, consider these actionable approaches:

- Diversification is Key: Don't rely solely on AI predictions. Maintain a diversified portfolio across asset classes to mitigate risk. AI can help you identify optimal asset allocation, but it shouldn't be the only factor.

- Combine AI with Human Expertise: AI is a powerful tool, but it’s not a replacement for human judgment. Work with financial advisors who understand both traditional investment principles and the capabilities of AI.

- Explore Specialized Platforms: Numerous platforms offer AI-powered investment tools for specific needs – from cryptocurrency trading bots to AI-driven stock screeners. Research and choose a platform that aligns with your investment goals and risk tolerance. Companies like Kensho Technologies and Numerai are pioneers in this space.

- Consider Factor Investing: AI can excel at identifying and exploiting specific investment factors (e.g., value, momentum, quality) that have historically generated higher returns. This approach combines the power of AI with established investment principles.

- Embrace Quantitative Investing: This involves using mathematical and statistical models to make investment decisions – a natural fit for AI.

Risk-Aware Options: While AI offers potential for higher returns, consider the risks associated with relying solely on algorithmic trading. Market volatility, data bias, and unforeseen events can all impact performance.

Use Cases & Applications

The applications of AI-driven investment strategies are diverse and expanding rapidly:

- Wealth Management: Robo-advisors are empowering individuals to manage their finances more effectively and affordably. They personalize investment portfolios based on individual needs and goals.

- Hedge Funds: Many hedge funds are leveraging AI to identify arbitrage opportunities, manage risk, and generate alpha (returns above the market average).

- Private Equity: AI is used for due diligence, deal sourcing, and portfolio monitoring in the private equity space.

- DeFi Investing: AI algorithms can analyze DeFi protocols to identify profitable lending opportunities, assess smart contract risk, and optimize yield farming strategies. Platforms like Enzyme Finance are leveraging AI for decentralized asset management.

- Corporate Finance: Companies are using AI for forecasting, risk management, and investment decision-making.

Common Mistakes to Avoid

- Over-Reliance on Past Data: AI algorithms are trained on historical data, so they may not accurately predict future market behavior, especially during periods of significant change.

- Ignoring Data Quality: "Garbage in, garbage out" applies to AI. Poor quality data can lead to inaccurate predictions and poor investment decisions.

- Lack of Transparency: Many AI algorithms are "black boxes," making it difficult to understand how they arrive at their decisions. This lack of transparency can be problematic for risk management.

- Failing to Monitor and Adjust: AI models need to be continuously monitored and retrained to adapt to changing market conditions.

- Ignoring Regulatory Changes: The regulatory landscape for AI in finance is still evolving. Failing to comply with regulations can lead to legal and financial consequences.

Maintenance, Security & Long-Term Planning

Maintaining AI-powered investment solutions requires ongoing attention. Key considerations include:

- Cybersecurity: Protecting AI algorithms and data from cyberattacks is paramount. Implement robust security measures to prevent data breaches and unauthorized access.

- Data Governance: Establish clear data governance policies to ensure data quality, privacy, and compliance.

- Model Monitoring & Retraining: Continuously monitor the performance of AI models and retrain them regularly with new data to maintain accuracy.

- Regulatory Compliance: Stay up-to-date with evolving regulations surrounding AI in finance.

Scalability is also critical. Ensure your chosen platform or solution can handle increasing data volumes and user demand as your investment portfolio grows.

Summary & Key Takeaways

AI-driven investment strategies are no longer a futuristic concept; they are a present-day reality reshaping the financial landscape. By leveraging the power of algorithms and machine learning, investors can potentially enhance their portfolio performance, manage risk more effectively, and gain a competitive edge. However, it's crucial to approach AI with a balanced perspective, recognizing its limitations and combining it with human expertise and sound investment principles. The rise of generative AI in finance is poised to further revolutionize the industry.

What are your thoughts on AI in investing? Share your experiences and insights in the comments below! Would you like a deeper dive into a specific AI tool or strategy? [Link to a related article on our blog].

FAQs

Is it too late to invest in crypto?

No, it's not too late to invest in crypto, but it's crucial to do your research and understand the risks involved. Crypto markets are highly volatile, and regulatory uncertainty remains a factor. AI can help you analyze crypto projects and manage risk, but it doesn't guarantee profits.

How can small businesses use AI?

Small businesses can leverage AI for a variety of tasks, including customer service chatbots, marketing automation, and data analysis. Many affordable AI tools are available specifically for small businesses.

What tech stacks scale best?

Tech stacks

Share this content:

Post Comment