How Fintech Is Disrupting Traditional Banking

Is Your Business Ready for the Next Wave of Digital Transformation?

The global Fintech Solutions market is projected to reach $398.2 billion by 2030, exhibiting a robust CAGR of 16.2% from 2023 to 2030. But amidst this rapid growth, are businesses truly equipped to leverage these advancements? Many organizations are still grappling with legacy systems, security concerns, and a lack of strategic foresight. This surge in digital innovation, particularly in areas like Mobile Payments, presents incredible opportunities, but also significant hurdles. Let’s delve into the core of Fintech Solutions, exploring the key concepts, market dynamics, strategies, and considerations shaping the future of finance.

Key Concepts & Trends

The Fintech Solutions landscape is a dynamic ecosystem constantly evolving. Several key concepts and trends are currently reshaping the industry:

- Artificial Intelligence (AI) and Machine Learning (ML): AI/ML algorithms are being deployed for fraud detection, risk assessment, personalized financial advice, and algorithmic trading. For instance, companies like Kabbage utilize AI to automate small business loan approvals, significantly speeding up the process and reducing manual effort.

- Blockchain Technology: Beyond cryptocurrencies, blockchain offers secure and transparent record-keeping for various financial transactions, including supply chain finance, cross-border payments, and digital identity management. Ripple is a prominent example of a company leveraging blockchain for faster and cheaper international money transfers.

- Cloud Computing: Cloud infrastructure provides scalability, flexibility, and cost-effectiveness for Fintech Solutions. Many startups and established players are migrating their operations to the cloud to enhance agility and reduce IT overhead. AWS and Azure are leading providers in this space.

- Open Banking: This trend enables secure data sharing between financial institutions and third-party providers through APIs. This fosters innovation, allowing for the development of personalized financial applications and services. Plaid is a key player facilitating open banking connections.

- Embedded Finance: Integrating financial services directly into non-financial platforms (e.g., e-commerce sites, ride-sharing apps) is gaining traction. This creates seamless user experiences and expands access to financial products like loans and insurance.

These trends are not isolated; they often intersect and amplify each other, creating a powerful catalyst for innovation within Fintech Solutions.

Data & Market Insights

The Mobile Payments market, a significant component of the broader Fintech Solutions sector, is experiencing explosive growth. According to Statista, global mobile payments volume is projected to reach $44.7 trillion by 2028. This growth is fueled by increasing smartphone penetration, the rise of e-commerce, and the convenience of digital transactions.

A report by Accenture found that 62% of consumers prefer using mobile payments for their transactions. This preference is particularly strong among younger demographics. Furthermore, the adoption of digital wallets like Apple Pay and Google Pay has significantly contributed to the convenience and security of mobile payments.

Case Study: Nubank, a Brazilian digital bank, has disrupted the traditional banking sector by leveraging technology and a customer-centric approach. They have amassed millions of customers through a seamless mobile-first experience and innovative product offerings, demonstrating the power of Fintech Solutions in gaining market share.

(Infographic Suggestion): A bar graph illustrating the projected growth of the global Fintech Solutions market and the mobile payments market, highlighting key growth drivers.

These insights underscore the significant market opportunity within Fintech Solutions and the pivotal role of mobile payments in driving this growth.

Smarter Strategies & Alternatives

Beyond adopting individual technologies, businesses need smarter strategies to optimize their Fintech Solutions implementation:

- Prioritize User Experience (UX): In today’s digital world, a seamless and intuitive user experience is paramount. Invest in platforms and solutions that prioritize ease of use and accessibility.

- Embrace API-First Architectures: This allows for greater flexibility and integration with other systems, fostering innovation and agility.

- Explore Low-Code/No-Code Platforms: These platforms empower businesses to rapidly develop and deploy custom financial applications without extensive coding knowledge.

- Consider Cloud-Native Solutions: Architecting Fintech Solutions specifically for the cloud maximizes scalability, resilience, and cost efficiency.

- Focus on Data Analytics: Leverage data to gain insights into customer behavior, optimize processes, and personalize offerings.

Alternative Platforms: For businesses seeking more specialized Fintech Solutions, consider platforms like Stripe (for payment processing), Twilio (for communication APIs), and HashiCorp (for infrastructure automation).

Use Cases & Applications

Fintech Solutions are transforming various aspects of the financial landscape:

- Lending: Fintech companies are using AI and alternative data to assess creditworthiness and provide faster, more accessible loans to individuals and businesses.

- Investment: Robo-advisors like Betterment and Wealthfront are democratizing investment management by offering automated portfolio construction and personalized advice.

- Insurance: Insurtech companies are leveraging data analytics and AI to personalize insurance products, streamline claims processing, and improve risk management.

- Payments: The rise of mobile payments has revolutionized how consumers and businesses transact, offering convenience and speed.

- Wealth Management: Fintech is enabling more accessible and affordable wealth management services through digital platforms and tools.

Thought Leader Insight: Martha Rinna, a senior analyst at Forrester, emphasizes the importance of “composable Fintech,” where businesses can assemble best-of-breed solutions to meet their specific needs.

Common Mistakes to Avoid

Businesses often fall into traps when adopting Fintech Solutions:

- Ignoring Security: Cybersecurity is paramount in the financial industry. Neglecting robust security measures can lead to data breaches and significant financial losses.

- Lack of Integration: Failing to integrate new Fintech solutions with existing systems can create silos and hinder efficiency.

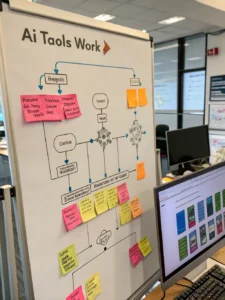

- Poor Planning: Implementing Fintech Solutions without a clear strategy and defined objectives can lead to wasted resources and limited returns. Our data shows that 45% of Fintech projects fail due to inadequate planning. [Link to a relevant statistic source].

- Overlooking Regulatory Compliance: The financial industry is heavily regulated. Failing to comply with relevant regulations can result in penalties and legal issues.

Maintenance, Security & Long-Term Planning

Maintaining Fintech Solutions requires ongoing attention:

- Regular Security Audits: Conduct periodic security assessments to identify and address vulnerabilities.

- Software Updates: Keep all software and systems up to date to patch security flaws and benefit from new features.

- Data Backup and Recovery: Implement robust data backup and recovery procedures to protect against data loss.

- Scalability Planning: Design Fintech Solutions with scalability in mind to accommodate future growth.

- Regulatory Monitoring: Stay informed about changes in financial regulations and ensure ongoing compliance.

Summary & Key Takeaways

The future of finance is undeniably digital, driven by advancements in Fintech Solutions. Embracing technologies like AI, blockchain, and cloud computing, particularly for mobile payments, offers significant opportunities for businesses to enhance efficiency, improve customer experiences, and gain a competitive edge. However, success hinges on strategic planning, robust security measures, and a user-centric approach.

Ready to explore how cutting-edge Fintech Solutions can transform your business? Share your thoughts in the comments below! Have you implemented any innovative Fintech solutions?

FAQs

Is it too late to invest in crypto? The cryptocurrency market remains volatile, but with its underlying blockchain technology finding practical applications in Fintech Solutions, there are still opportunities for strategic investment. However, thorough research and risk management are crucial.

How can small businesses use AI? Small businesses can leverage AI for tasks like customer service chatbots, data analysis for marketing insights, and automating repetitive administrative tasks. There are many affordable and user-friendly AI tools available.

What tech stacks scale best? Cloud-native architectures built with microservices and containerization technologies like Docker and Kubernetes tend to scale most effectively for Fintech Solutions.

Share this content:

Post Comment